The social and environmental concerns around how to dispose of lithium batteries that EVs are usually powered by are now coming to light. First, there is clear concern around the level of virgin raw material mining needed for their manufacture. This reliance on metals and minerals as the foundation of this technology presents significant environmental and social issues.

The other problem is, of course, how to dispose of lithium car batteries once they have reached the end of their useful lives—an issue compounded by the types of materials used during manufacture. Today, you can recycle lithium car batteries, and this is the best way to minimize the mining of new raw materials, however, they are not as easily recycled as more conventional lead-acid batteries usually found in cars.

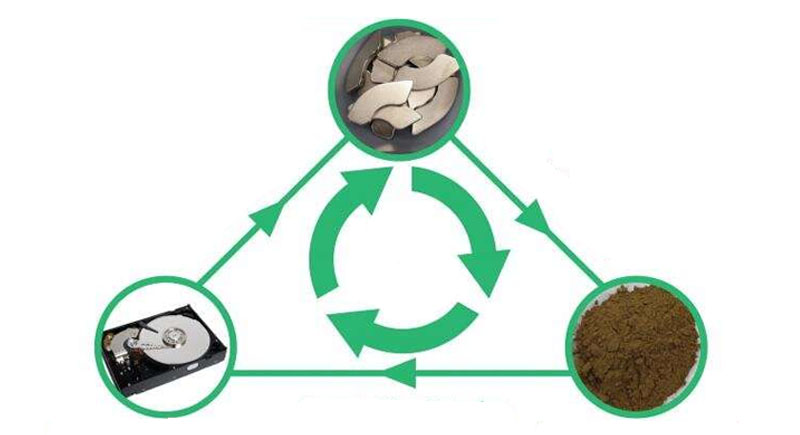

Most commonly, lithium batteries are recycled in large plants by a process of shredding the whole battery down to a powder. This powder is then either smelted (pyrometallurgy) or dissolved in acid (hydrometallurgy), thereby extracting the individual elements for resale.

Research is ongoing to develop the batteries of the future, and these may require a different mix of raw materials, but lithium in particular looks likely to be essential for decades to come. Although battery recycling will be increasingly important, stocks of used batteries that could be recycled right now are very low compared to anticipated demand. This means that understanding the geology and natural resources of lithium is vital, as this will underpin exploration and mining for this critical raw material.

Further, the Government of India has also taken due steps to support these domestic producers by providing various financial incentives like Niti Aayog, a think tank chaired by Prime Minister Narendra Modi, has proposed to provide output linked subsidy of cash which would be based on kilowatt-hours (KWh) of the cells sold, to reinstate their commitment to support the manufacture of batteries in India. In October 2019, the Government of India announced that it is in process of framing a recycling policy for lithium-ion batteries under which tax sops will be offered to recyclers. The proposed policy also expected to have incentives for companies to set up recycling facilities and make it incumbent on producers to collect used batteries.

The manufacturing, re-use, and recycling of batteries would lead to a circular economy where the manufacturers would either double up as recyclers or new entrants with the sole focus on recycling of batteries would enter the market. To meet the increasing demand, the Government of India had also announced income tax exemptions for prospective Electric Vehicle (EV) buyers and reduced Goods and Services Tax (GST) on EVs from 12% to 5%; and is actively considering incentivising manufacture in electric vehicle segment by proposing a turnover based incentive. Cell manufacturing costs in India, as of 2020, were projected to be the lowest (US$92.8/kWh) when compared with the United States, European nations and even China (US$98.2/kWh) and South Korea (US$98.1/kWh).

Similarly, India has huge cost opportunities in terms of cheap labour and power (gross monthly minimum wage levels in India in 2019 were US$65 against US$217 in China.